Pricing, Features, Pros and Cons

-

by Anoop Singh

- 11

Square’s fast factsOur star rating: 4.2 out of 5 stars Pricing:Starts at $6/person for the pay contractors-only plan or $35/month plus $6/person for the pay employees and contractors plan. Key features:

Workers’ comp insurance, healthcare and retirement benefits integration. |

Paycor

Employees per Company Size

Micro (0-49), Small (50-249), Medium (250-999), Large (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Employees), Small (50-249 Employees), Medium (250-999 Employees)

Micro, Small, Medium

Features

API, Check Printing, Document Management / Sharing, and more

If your business already uses the Square app ecosystem for payments, point of sale or time tracking, then you might be wondering if Square Payroll is the right choice for you. Square Payroll is a simple, affordable payroll platform that may be enough for many small businesses, but it also lacks the scalability and advanced features that bigger companies need. In this review, I break down Square Payroll’s pricing and features and investigate the pros and cons to help you decide if it’s the right choice for your business.

Square Payroll pricing

Square Payroll offers two simple and transparent pricing plans: one for paying employees and contractors, and one for paying only contractors. There are also add-ons available for an undisclosed price. A trial version is not available to test out beforehand, which I definitely consider a drawback.

Full-Service Payroll

This plan costs $35 per month plus $6 per employee per month. With this plan, you can pay both employees and contractors. It offers significantly more features than the Contractor-Only plan, such as auto payroll, multistate payroll and multiple pay rates. This plan also offers next-day, two-day and four-day direct deposits, plus additional tools for time tracking, scheduling, taxes and compliance.

Contractor-Only Payroll

This plan doesn’t have a base fee and costs $6 per contractor per month. It offers very limited features compared to the Full-Service Payroll plan. It does support unlimited pay runs per month, so you don’t have to worry about additional fees. It also allows you to pay contractors by check, direct deposit or Cash App. With this plan, you can import your team’s time cards from other Square products, but it doesn’t offer any native tools for time tracking or scheduling.

Optional add-ons

Square Payroll offers optional add-ons for an undisclosed price. Some of these features are included on the Full-Service Payroll plan, although they can be added to the Contractor-Only Payroll plan; other features are add-ons only for both plans. These are some of the add-ons:

- Workers’ compensation.

- Paid amendment services.

- Direct access to certified HR experts.

- Employee handbook builder.

- Health insurance administration.

- 401(k) retirement benefits.

Key features of Square Payroll

Payroll for employees

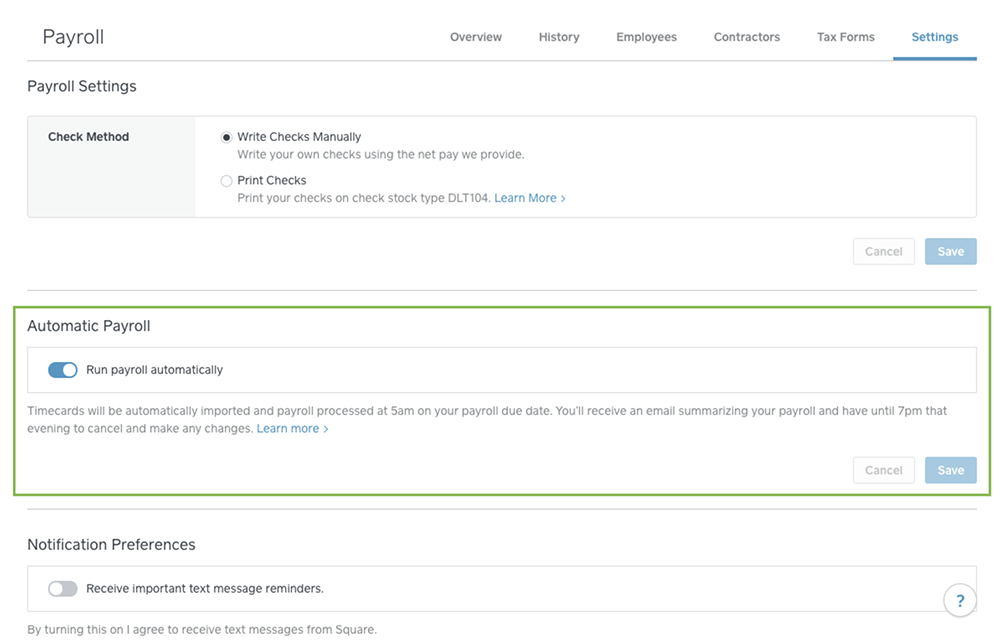

Both Square Payroll plans get unlimited payroll runs, so you won’t be charged a fee every time you run payroll. The Full-Service Payroll plan supports automatic payroll (Figure A), so you can schedule it to run on a predetermined time if you’ll be away from your desk. Both plans allow you to pay employees through check, direct deposit or Cash App, so workers can choose what works best with them.

With the Full-Service Payroll plan, your business can run payroll in all 50 states (Square doesn’t support international payroll). I appreciate that Square doesn’t require you to pay more to run payroll in more than one state, unlike some competitors like Gusto that force you to upgrade to a more expensive plan for that option. This plan supports off-cycle payments and multiple pay rates, which is useful if you need to pay different employee groups at different times.

The Full-Service Payroll offers not just two-day and four-day direct deposits but also next-day deposits. Not all payroll services offer next-day deposits, and some charge an extra rush fee, so it’s nice to have this option in case you need to pay employees quickly.

Taxes and compliance

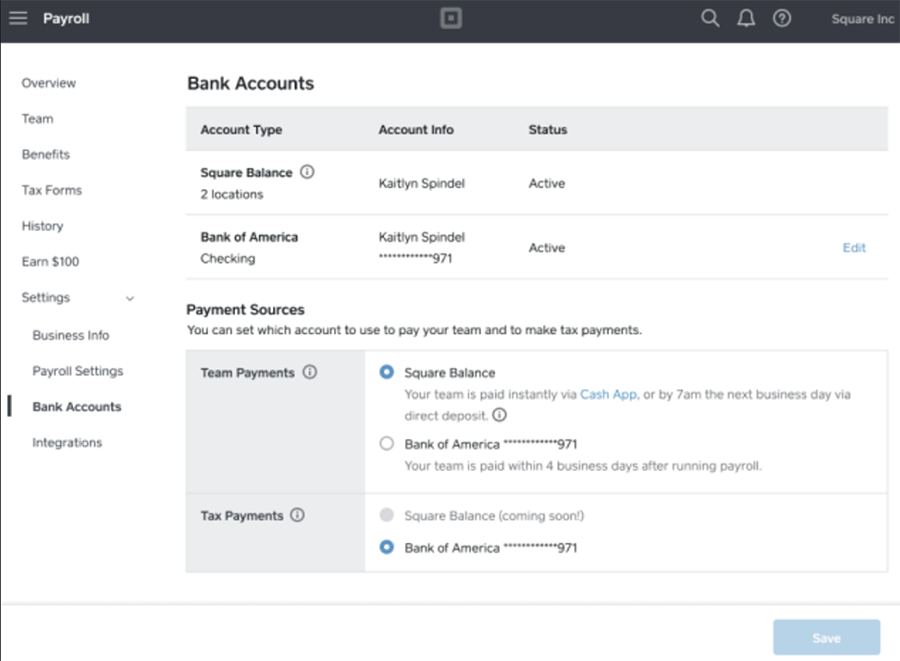

Both of Square Payroll’s pricing plans include automatic payroll tax calculations and digital delivery of W2 and 1099 forms; mailing paper copies costs $3 per mailed form. The Full-Service Payroll plan includes automated payments and filing for both federal and state taxes (Figure B). This plan will issue automatic compliance alerts for both federal and state tax laws. Keep in mind that contractors are responsible for calculating and paying their own taxes, which is why these features aren’t included on the Contractor-Only Plan.

Time and scheduling

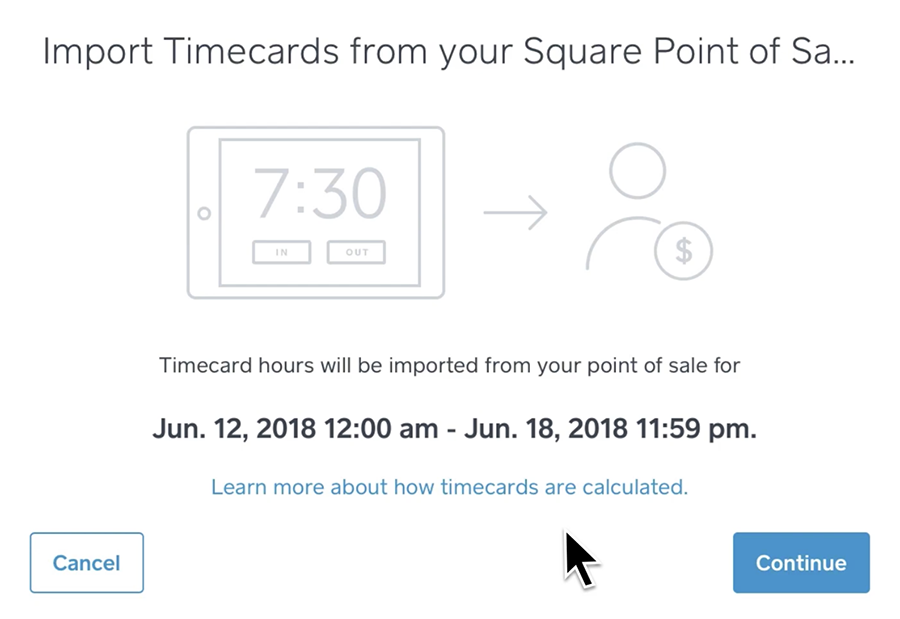

Square Payroll offers basic team management features on the Full-Service Payroll plan, but its features don’t compare to the more advanced plans offered by alternatives like Rippling and ADP. With this plan, managers can schedule up to 10 days out and sync timecards from other Square products and third-party solutions (Figure C). It also offers direct-tip tracking and importing, overtime calculations and labor cost reporting.

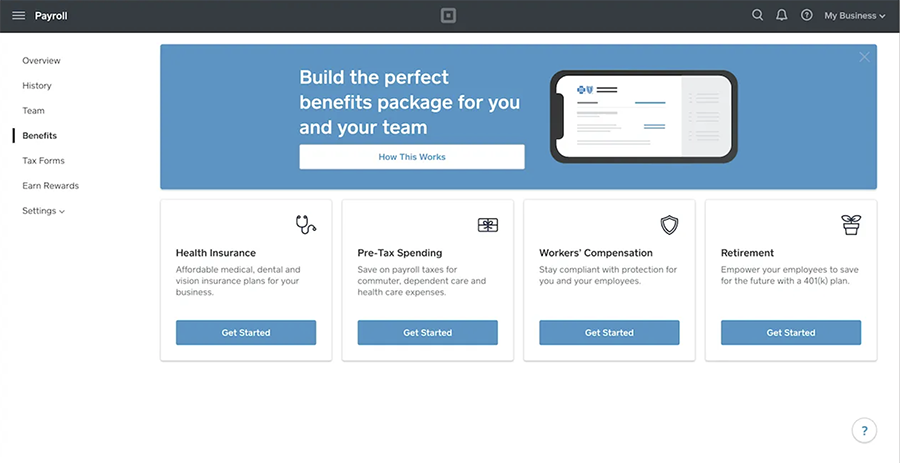

Benefits administration

Businesses can apply their existing benefits within the Square Payroll platform to gain taxable benefit deductions and contributions to their employees’ profiles. If you don’t already have a plan, Square has partnered with SimplyInsured so you can offer medical, dental and vision plans to your employees. Thanks to another partnership, Square Payroll allows you to add on the following benefits if you wish (Figure D): workers’ compensation (Next Insurance), retirement savings (Guideline) and HR compliance (Bambee).

Integrations

Square Payroll integrates seamlessly with other Square products, such as Square POS and Square Team Management; however, its integrations outside of Square are a bit limited. It does integrate with Homebase for scheduling and QuickBooks Online for accounting, but that’s about it. If you’re looking for a payroll platform that connects with many different apps, then I recommend checking out some Square Payroll alternatives like the ones I’ve listed at the bottom of this article.

Square Payroll’s pros

- Month-to-month pricing means you aren’t locked into an annual contract.

- Unlimited payroll runs and automatic payroll option.

- No base fee for Contractor-Only plan.

- Integrates seamlessly with other Square projects.

Square Payroll’s cons

- No free trial available.

- Features are limited compared to those of alternatives.

- Only two integrations with third-party software.

Alternatives to Square Payroll

| Feature | Square Payroll | OnPay | SurePayroll | Gusto |

|---|---|---|---|---|

| Unlimited payroll runs | Yes | Yes | Yes | Yes |

| Automatic payroll | Yes | No | Yes | Yes |

| Next-day deposit | Yes | No | Must meet certain requirements | Plus plan only |

| Third-party integrations | 2 | 10+ | 10+ | 190+ |

| Starting price per month | $35/month + $6/person | $40/month + $6/person | $19.99/month + $4/employee | $40/month + $6/person |

OnPay

![]()

Our star rating: 4.7 out of 5

OnPay’s full-service payroll and HR solution provides comparable payroll features with an easy-to-understand pricing model of $40 per month plus $6 per person paid. In addition, it includes tools and capabilities for automating taxes, payroll, HR processes and team management without requiring extra fees. Businesses can simplify their payroll operations by using OnPay to create custom payroll reports, perform PTO management and even streamline employee onboarding. OnPay offers a free one-month trial to new users.

Read our full OnPay review for more information.

SurePayroll by Paychex

![]()

Our star rating: 4.7 out of 5

SurePayroll by Paychex is another helpful option for businesses seeking robust reporting features within their payroll solution. The software simplifies payroll processes while allowing business leaders to gain valuable reports from various areas of their business operations. These customizable reports enable businesses to gain insights into employee, benefits and payroll data. In addition, SurePayroll by Paychex automates payroll for easy use and can be a helpful tool for catering to the unique needs of specific business settings, like nonprofit organizations and restaurants. Businesses can visit the SurePayroll by Paychex sales page for a price quote.

Read our full SurePayroll review for more information.

Gusto

Our star rating: 4.6 out of 5

Gusto is one of the most popular payroll platforms for small and medium size businesses, thanks to its highly intuitive interface. It offers multiple pricing plans for scalability, with the cost starting at $40 per month + $6 per person paid; however, it does limit certain desirable features such as next-day deposit and multi-state payroll to more expensive pricing plans. Gusto also offers a contractor-only plan that is the same price as Square. Gusto syncs with nearly 200 third-party platforms, so it offers far more integration options than Square.

Read our full Gusto review for more information.

Review methodology

To review Square Payroll, I consulted product documentation and user reviews. I investigated features such as payroll, tax calculations and filing, time tracking, scheduling, benefits administration and integrations. I also considered factors such as pricing plans, user interface design and customer support.

Square’s fast facts Our star rating: 4.2 out of 5 stars Pricing:Starts at $6/person for the pay contractors-only plan or $35/month plus $6/person for the pay employees and contractors plan. Key features: Multistate payroll services and live support from payroll specialists. Automatic filing of quarterly and annual taxes. Timecard, tips and commissions integration through Square…

Square’s fast facts Our star rating: 4.2 out of 5 stars Pricing:Starts at $6/person for the pay contractors-only plan or $35/month plus $6/person for the pay employees and contractors plan. Key features: Multistate payroll services and live support from payroll specialists. Automatic filing of quarterly and annual taxes. Timecard, tips and commissions integration through Square…