What Is a Payroll Register? Benefits, Best Practices and Examples

-

by Anoop Singh

- 12

A payroll register is a convenient way to keep track of all relevant payroll information in one single, centralized location. Keeping accurate and timely payroll registers makes it easier to calculate taxes and maintain compliance with all necessary federal, state and local laws.

If you’ve never made a payroll register before, we cover what you need to know about it.

Paycor

Employees per Company Size

Micro (0-49), Small (50-249), Medium (250-999), Large (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Employees), Small (50-249 Employees), Medium (250-999 Employees)

Micro, Small, Medium

Features

API, Check Printing, Document Management / Sharing, and more

What is a payroll register?

A payroll register is a record of each employee’s wage payment information for each pay date and pay period. It also includes information for all employees across each given time period, so you can easily view the overall totals.

Some of the information included on a payroll register includes gross pay, deductions, bonus payments, overtime payments, tax withholding, net pay and benefit payments. It typically doesn’t include taxes paid by employers, but it may include federal and state unemployment taxes.

Payroll registers can take many forms, from Excel spreadsheets to a physical payroll register book that you fill out by hand. Some accounting software, such as ADP, offer the option to automatically generate a payroll register report, which is very convenient. However, don’t get it confused with other reports that have similar names — a payroll register is not the same as a payroll detail report, paycheck history report or employee pay stub.

Payroll register structure

Each payroll register should generally include the following information:

- Name of each employee.

- Pay period.

- Pay date.

- Regular hours worked for each employee.

- Overtime hours worked for each employee, if applicable.

- Each employee’s net pay.

- Each employee’s pay rate.

- Each employee’s gross pay.

- Federal, state and local taxes withheld.

- Employee portion of Social Security and Medicare taxes.

- Any other applicable deductions (such as benefits).

- Employer benefits contributions, if applicable.

- Net payment details (paper check, direct deposit, paycard, etc.).

The payroll register should also include totals for each line item. Keep in mind that payroll recordkeeping laws vary according to jurisdiction, so be sure to consult all relevant federal, state and local laws when creating your payroll register structure.

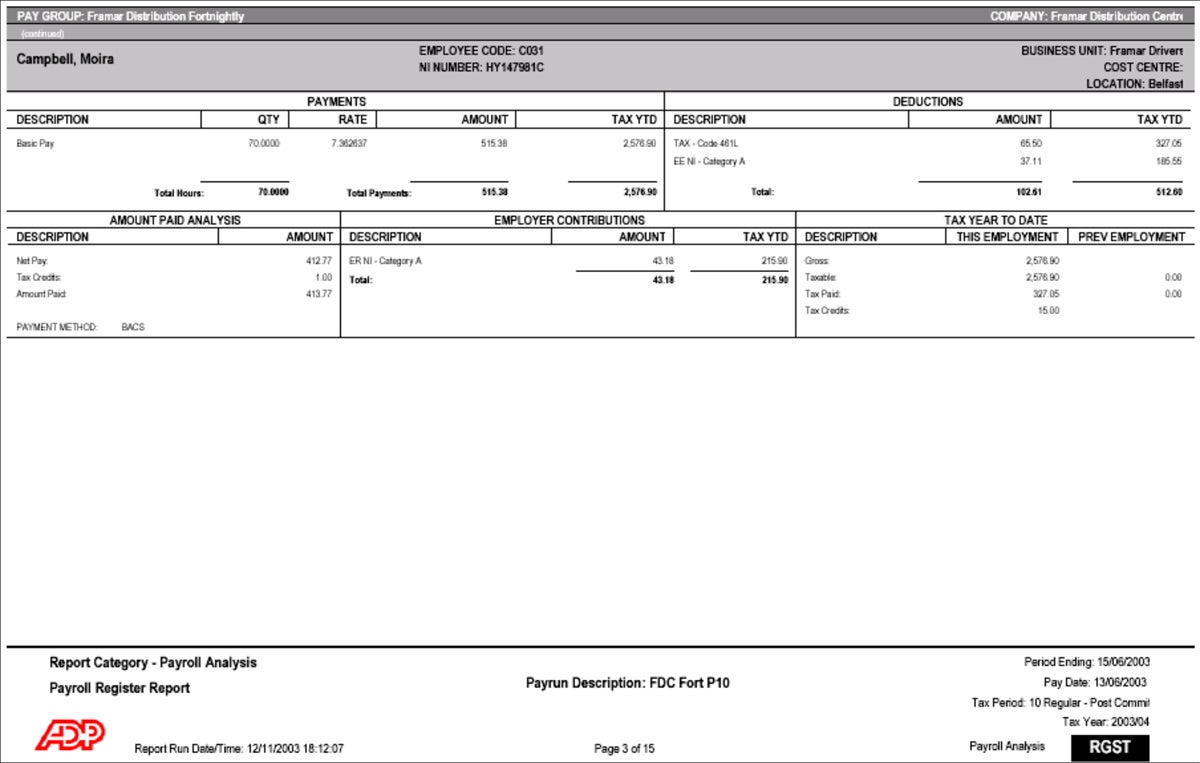

Example of a payroll register

Benefits of a payroll register

Keeping a well-documented payroll register offers many advantages to your business. Here are some of the things that you can do with a payroll register:

- Centralize all relevant payroll dates in one place.

- Keep track of hours and wages paid.

- Calculate how much cash is required to cover payroll.

- Forecast overtime costs for future pay periods.

- Review outgoing costs for the entire organization or on a per-employee basis.

- Budget tax payments for each pay period.

- Track employee deductions and withholdings.

- Provide payroll data and other information to worker’s compensation and insurance providers.

- Log employee leave time.

- Reconcile payroll expenses against the general ledger.

- Validate direct deposit transactions.

- Complete your company’s quarterly tax payments using Form 941.

- Maintain accurate and compliant payroll records.

Steps to create a payroll register

Creating a payroll register isn’t a complicated process, but you do need to follow a certain process to ensure each register entry is accurate and complete. Here are the steps you need to follow to create a payroll register:

- Figure out the frequency of payroll periods. Since you need to create a payroll register for each pay day, you need to know a list of upcoming payroll run dates.

- Gather all necessary documents and information. This includes your Employer Identification Number (EIN), state and local tax IDs, federal and state W-4 forms, time card information and compensation data for each employee. If you are adding new employees to the payroll, you will also need their I-9 form and their job application.

- Fill out the register. Take the information you gathered in step two and use that to fill out your payroll register, then calculate gross pay for each employee. If you’re using payroll software like ADP, it will automatically pull most of this data from other areas of the software and do the calculations for you.

- Determine taxes and deductions. Use the W-4s to calculate how much you need to subtract for taxes and deductions for each employee.

- Calculate net pay for each employee. Subtract the total amount of taxes and deductions from the employee’s gross pay to figure out their net pay (a.k.a. take-home pay).

- Review the payroll register entry. Double-check each employee’s pay entry for errors and resolve them before moving on to the next payroll register entry.

Best practices for using and maintaining a payroll register

Secure sensitive data

Payroll registers contain extremely sensitive data about your business’ finances and employees’ personal information. For this reason, you should take steps to keep your payroll registers secure and restrict access only to a handful of authorized personnel. For security purposes, we recommend staying away from physical registers or Excel spreadsheets and instead opting for accounting software with features like two-factor authentication.

Update the register often

Every time you create a payroll register, check it for changes and errors. Adjustments need to be made for salary increases or decreases, changes in deductions and fluctuating hours worked, just to give a few examples.

Stay current with compliance

Payroll laws can change at the federal, state and local levels at any time. Stay current with the latest changes in your jurisdiction and update your payroll records to reflect the changes as soon as they go into effect.

Hold on to payroll records

The IRS mandates that businesses hold onto payroll records, including payroll registers, for at least four years. Make sure to securely store your payroll registers for this amount of time in a place where they will be safe from unauthorized access.

What does it mean to prove the payroll register?

Proving a payroll register means verifying that all your calculations are correct and that your payroll data is accurate. You must ensure that each employee’s total earnings is equal to their net pay minus the sum total of all their deductions.

What is the difference between a payroll journal and a payroll register?

While they record wage information, a payroll register is not the same as a payroll journal. A payroll register breaks down information by employee, while a payroll journal summarizes payroll figures for the whole company. A payroll register is used to reconcile payroll and verify its accuracy, while a payroll journal is used to prepare financial statements.

A payroll register is a convenient way to keep track of all relevant payroll information in one single, centralized location. Keeping accurate and timely payroll registers makes it easier to calculate taxes and maintain compliance with all necessary federal, state and local laws. If you’ve never made a payroll register before, we cover what you…

A payroll register is a convenient way to keep track of all relevant payroll information in one single, centralized location. Keeping accurate and timely payroll registers makes it easier to calculate taxes and maintain compliance with all necessary federal, state and local laws. If you’ve never made a payroll register before, we cover what you…